Digital Platforms: Evolution of the marketplace to turbocharge your new business ideas and ventures

Digital platforms, also referred to as Multisided Platforms (MSPs) are technology-enabled business models. In its simplest form, the digital platform business creates value for its participants in two ways. The first, by rapidly bringing together large numbers of buyers and suppliers to transact and the second, by reducing search and transactional costs.

Renowned digital platforms such as Microsoft, Alphabet (formerly Google), Amazon, Apple, Alibaba, Tencent and Facebook, were not the pioneers of the model, but over the last 2 decades, have leveraged the growth of the internet, to develop extraordinary economies of scale and concentrate vast sums of wealth for their shareholders.

What can we learn from these digital behemoths as we look to the future and the growth of the sharing economy, characterised by “Anything-as-a-Service”, the democratisation of information and technology and the continued evolution of the customer experience?

Growth

First, let us review the drivers of rapid growth:

- Increased visibility over a sizable market - They were able to aggregate, fragmented demand and supply into a single platform or interface, where the time element of “search” was reduced to seconds and where physical distance between buyer and seller, played only a partial, or no role in the decision to proceed with the transaction.

- Concept of Blitzscaling - They leveraged the networks, capabilities, products and services of third-party suppliers, to rapidly develop network ecosystems of scale. This compared to the traditional, linear development of supply chains and subsequent stepwise functional recruitment.

- Multisided - The addition of more sides to the platform, i.e. a new dimension of participants that add complementary services and products and hence more revenue streams.

- Feedback loops - Use of digital technologies to create positive feedback loops that increased the value of the platform with each subsequent new participant (reviews, matching and customised advertising)

Growth inhibitors

Now let us look at potential growth inhibitors and challenges that are not always apparent.

- Vertical integration and conflicts between the digital and physical worlds:

- A somewhat common feature amongst the technology-enabled platforms (though not all) is that they do not own the underlying assets, or the means of production, but exists to create and facilitate the means of connection (the platform) between two or more participant groups, e.g. Alphabet, Alibaba, Airbnb, Spotify, Netflix, Instacart, Uber, Lyft. The digital-only, or asset-light feature is much publicised by technology reporters and loved by entrepreneurs and investors alike. Caution is required however, because several of these platforms are a combination of the physical and digital worlds (i.e. atoms and bytes).

- A point of equilibrium exists between the digital capability to connect participants at speed and the physical capacity to deliver services/products. A key determinant of this is market price sensitivity and the attractiveness of price point and available margins to the service providing participants, e.g.

- Amazon has become more vertically integrated and now owns an increasing portfolio of warehouses and other logistical assets to strengthen its distribution channel capacity, a low margin, support operation.

- Uber and Lyft, the ride-hailing platforms, have seen their lofty market valuations tumble by 32% and 56% respectively, because they operate in a low margin market and have favoured scale over profit. Losses are compounding and it is now apparent that growth is limited by price point for one side of the platform, whereby there is a minimum where it is no longer attractive for independent drivers to offer their services via the platform. Apart from further diversification (e.g. Uber), we may well see a level of vertical integration, whereby both these giants take ownership of one side of the platform, i.e. their fleets, to increase gross margins.

- Platform friction

The addition of more sides to the platform enables the acceleration of cross-side network effects, whereby the value to customers on one side of the platform increases with the number of participating customers on the other side. This step, however, can also be counterproductive, because of conflicting needs and/or perspective, e.g.

- A fresh produce platform with a customer base interested in quality organic, fresh produce, may introduce a range of low-cost producers to increase product range and order fulfilment, but this may cause friction and destruction of the customer’s concept of value, hence they leave the platform.

- Facebook facing customer and employee revolt over its policy to allow political campaign advertising and audience targeting on its platform.

Performance

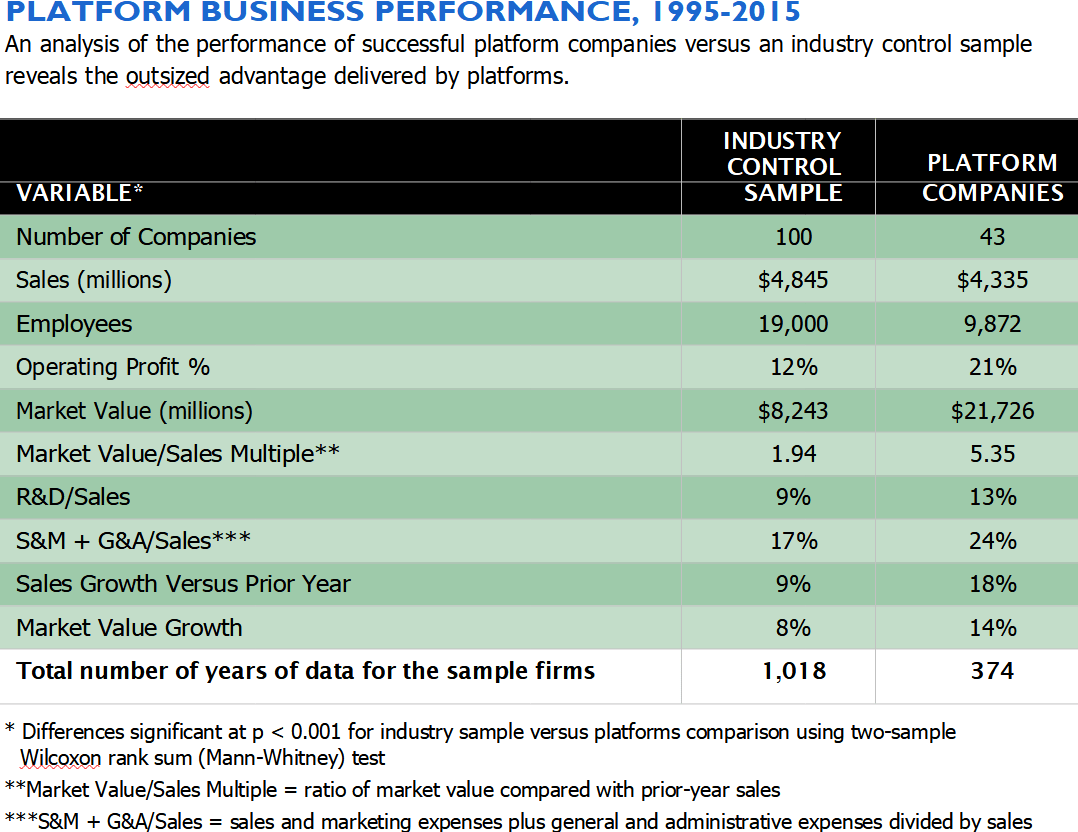

In their seminal work, The Business of Platforms (summary in Figure 1), authors Michael Cusumano, David Yoffie and Annabelle Gower, neatly provided the evidence to show that over a defined period of 10-years, digital platform companies outperformed traditional non-platform companies. The digital platform companies delivered similar revenue, with half the people, but were twice as profitable, grew twice as fast and were twice as valuable at the end of the period. Based on available data, they achieved this in about a third of the time required by non-platform companies.

Figure 1: Platform business performance (Source: THE BUSINESS OF PLATFORMS: STRATEGY IN THE AGE OF DIGITAL COMPETITION, INNOVATION, AND POWER, HARPER BUSINESS, 2019)

Characteristics

Some of the key characteristics of successful digital platform businesses:

- The digital model allows for the seamless, yet rapid addition, of consumers at low to zero costs, hence can push-out demand very quickly, that was not apparent, or possible before.

- The inherent features to quickly connect vast numbers of participants (both consumers and suppliers), help leverage capital, labour, data and algorithms to improve matches that reinforce scalability.

- “Cross-side” network effect,” whereby the value to customers on one side of the platform increases with the number of participating customers on the other side, e.g. the addition of more sides to the platform add more numbers (participants) and diversification (complementary products/services).

- As it handles large volumes of data and information, it serves as the bedrock for customised analytics and algorithms that enhance transactional flow, e.g.

- Customer preferences

- Pricing optimisation by location

- Product/Service availability by location

- Payment processing

- As a business model, it has the inherent ability to facilitate liquidity, i.e. the assurance that a transaction will happen without huge price fluctuations.

Future

What does the future hold for platform businesses as a mechanism to develop and scale new value propositions, i.e. product and services?

We have seen the advantages digital platforms hold and the efficiencies created using the web and mobile technologies, combined with Artificial Intelligence (AI) and Cloud computing. This trend will continue, and we will see digital platforms rise over a wider range of business ecosystems (particularly in service delivery), by increasing market visibility through data, further and expanded use of AI to facilitate speed to value. So, the numbers and diversity of digital platform businesses will rise, but it will become harder to duplicate the disruptive potential and scale of monetisation of those from the previous two decades.

Conclusion

On balance, we can conclude that digital platforms offer significant advantages over the traditional marketplace, or non-platform businesses, but the trade-offs between the digital and physical worlds, along with market price sensitivity and available profit margin, remain important considerations.

Furthermore, CXOs, leadership teams and founders must keep in mind that customer expectations change over time, hence businesses should leverage technology to capture these market signals, but further, to enhance operating agility that would enable them to exploit these changes at speed.

Kyanite360 is a digital solutions provider and together with our partners and the wider ecosystem, we are building platform opportunities and supporting customers in building future-fit organisations.